19+ Fsa loan calculator

A 10000 loan for 10 years at 10 should be 130 a month. 2021 Tax Calculator to Estimate Your 2022 Tax Refund.

Farm And Dairy Newspaper May 9 2019 By Farm And Dairy Newspaper Issuu

4236 on parent PLUS loans.

. If your FAFSA has been chosen for verification Ohio State will send a notification to your university email instructing you to review your financial aid To Do List in My Buckeye LinkYour To Do List items will include which. Assistance is available in counties or contiguous counties who have been designated as emergencies by the President Secretary or FSA Administrator. Enter the same number of Dependents you had entered on.

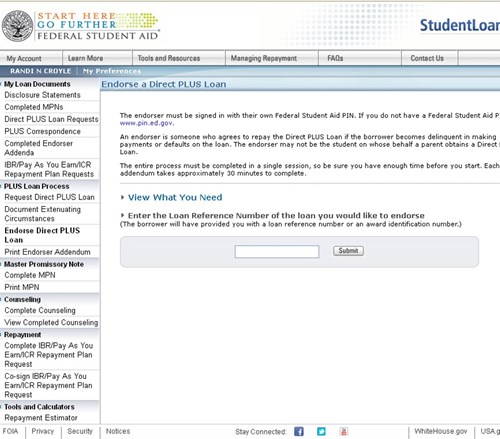

This in turn caused 2020 to be a record year for home loan origination volume with roughly 27 trillion of 41 trillion in mortgage volume being refinance loans. Article that provides an overview of Loan Simulator a tool to help students decide how much to borrow and understand what repayment would look like. Grace Period Interest Savings Calculator.

If you have a Federal Direct Loan youll be assigned a federal loan servicer after the first disbursement of your loan. Form 1098-E Student Loan Interest Statement. Department of Educations central database for student aid.

Here are some examples if you were paying more its likely PPI was included. Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US. FSA began transferring the PSLF program borrowers and their loans in stages from FedLoan Servicing to MOHELA in early July 2022 and this process will continue into September 2022.

The growth hike was reported to soar as high as 20 which amounts to around 347000 second-hand cars sold. We provide virtual counseling and have. What people are saying.

Main campus undergraduate students taking summer courses can request federal funds using the summer financial aid process. Form 8889 Health Savings Accounts HSAs. Net-Pay Calculator Paycheck Comparison DCP Basics.

These would normally. The COVID-19 crisis caused interest rates to crater with mortgage rates reaching fresh all-time lows. WPRO-19 Dependents or Children under the age of 17.

Use our loan calculator to enter your loan amount length and APR and compare with what you were paying. The sales of used cars between January to May in the said year have been skyrocketing despite COVID-19. Contact Edfinancial Services for assistance in managing your student loan accounts where to mail your payments or how to reach a customer service representative.

Or submit a complaint directly to the FSA Ombudsman. Federal Student Aid. 708 on parent PLUS loans.

Student loan interest qualified tuition and education-related fees up to 4000 etc. Financial Aid at a Glance. You can learn more about loan servicers at StudentAidgov or My Federal Student Aid to view view information about all of the federal student loans you have received and the loan servicer for your loans.

The Office of Financial Assistance is currently processing the Free Application for Federal Student Aid FAFSA for the 2022-2023 year Summer 2022 Fall 2022 and Spring 2023. Due to the financial impact of COVID-19 the CARES increases the maximum loan amount to 100000 currently 50000 and permits loans of 100 currently 50 of the. Act was signed into law to address economic impacts associated with COVID-19.

1062 on direct undergraduate loans vs. Student budgets are comprised of the average cost of the following expenses tuition room and board books and supplies transportation expenses personal expenses and loan fees. Electronic Loan Deficiency Payments eLDP eLDP services allow producers to request LDPs online and provides greater flexibility to producers who conduct business online and want to avoid travel time to and from the local FSA office.

Form 1098 Mortgage Interest Statement. 505 on direct undergraduate loans disbursed on or after 7118 and before 7119 vs. Federal Student Aid.

The Versatile Student Loan Calculator. A 5000 loan for 5 years at 5 should be 95 a month. FSA loan eligibility varies by grade level and dependency status.

A service member can qualify for both FSA I and FSA II simultaneously during the same time. Disaster Set-Aside Program provides producers who have existing direct loans with FSA who are unable to make the scheduled payments to move up to one full years payment to the end of the loan. Because different categories of students have different expenses each student is assigned a budget reflecting his or her particular costs.

Form 4952 Investment Interest Expense Deduction. Loan Simulator article Result Type. Ahead of the August 31 expiration of the Covid-19 payment freeze the Department of Education instructed student loan servicers to hold off on sending out billing statements.

You have a network of support to help you succeed with your federal student loan repayment. Use our car loan calculator to find the financing deal that best suits your budget. All service members must submit a Statement to Substantiate Payment of Family Separation Allowance DD Form 1561 to their servicing personnel office in order to apply for FSA payments.

FSA is a payment only available to service members with dependents. PHEAA conducts its student loan servicing operations for federally-owned loans as FedLoan Servicing. Or submit a complaint directly to the FSA Ombudsman.

Find county loan deficiency payment rates in a snap. Approval from FSA 2013 would be required. Federal Student Aid is committed to providing electronic and information technologies that are accessible to individuals with disabilities by meeting or exceeding the requirements of Section 508 of the Rehabilitation Act 29 USC.

An FSA or flexible spending account sponsored by your employer allows you tax-advantaged savings for out-of-pocket healthcare or dependent care costs. COVID-19 emergency relief for federal student loans has been extended through. Federal student loan flexibilities for the COVID-19 emergency have been extended through Decemeber 31 2022.

FSA is a tax-advantaged account that is usually offered by employers to. Give us a call 844 937-8679 Mon-Fri 5am to 7pm MST Saturday 6am to 5pm MST Sunday 12pm to 4pm MST.

Printable Sample Credit Reference Letter Form Reference Letter Letter Form Reference Letter Template

Cost Search Results Student Financial Services Washington State University

Free 15 Construction Timesheet Samples In Pdf Ms Word

Cost Search Results Student Financial Services Washington State University

Free 15 Construction Timesheet Samples In Pdf Ms Word

2

Cost Search Results Student Financial Services Washington State University

2

2

2

2

Statement Of Professional Standing Essential For All Financial Advisers From January 2013 Financial Advice Financial Advisors Financial

2

2

2

Cost Search Results Student Financial Services Washington State University

2