Calculate my hourly pay

Holiday pay can apply to both hourly and salaried employees the difference for holiday between hourly vs. For instance if your hourly rate is minimum wage 950 and you work 8 hours per day you will get paid 76 each day.

How To Calculate Gross Weekly Yearly And Monthly Salary Earnings Or Pay From Hourly Pay Rate Youtube

2250 15 x 15.

. This number is the gross pay. Use your gross not net paythat is your amount before taxesand multiply the number by the number of pay periods in a year. I had to consider my self employed tax travel and things I had to pay for to deliver client work.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. In the event of a conflict between the information from the Pay Rate Calculator. The Pay Rate Calculator is not a substitute for pay calculations in the Payroll Management System.

Calculate the gross wages based on a net pay amount. Many people may already know their yearly salary but in the event that you dont check your most recent pay stub. For example if the employees annual pay is 12000 and there are 24 pay periods in a year their gross pay per period is 500.

To calculate a paycheck start with the annual salary amount and divide by the number of pay. For premium rate Double Time multiply your hourly rate by 2. How to calculate take-home pay.

Other pay or benefits should be added. Ranges from an average of 1147 to 1981 an hour. When I started life as a UK sole trader I quickly realised that calculating my self employed hourly rate was going to take more than just charging the same as my competitorsOr just simply accepting what clients were willing to pay me.

The average hourly pay for an Electrician in Australia is AU3318. Use the dual scenario hourly paycheck calculator to compare your take home pay in different hourly scenarios. Determine tax income bracket.

Employees on hourly rates get paid in wages and are typically paid weekly or monthly. What Are the Differences. Total Monthly Living Expenses L Total Monthly Business Expenses B Total Billable Hours Per Month H Total Taxes T Your Minimum Hourly Rate LH 1 T BH Example.

Also you may want to see if you have one of the 50 best jobs in America. Once you have Janes standard hourly pay rate you can use the equation provided above to calculate her time and a half pay rate. To calculate an employees gross pay start by identifying the amount owed each pay period.

Convert my salary to an equivalent hourly wage. Employees with the job title Pharmacy Technician make the. Calculate federal state and local income taxes.

Using 600 as Janes weekly pay rate and dividing it by 40 you can find her standard hourly pay rate. Calculate your FICA taxes for the year. Hourly Rate Calculator 20222023.

To compute the gross pay of employees with an annual rate divide the total amount of yearly pay by the number of pay periods within a year. You must pay nonexempt employees at least the federal state or countycity minimum wage whichever is higher and overtime pay time and a half for any time worked over 40 hours in a week. Use this calculator to determine what your hourly wage equates to when given your annual salary - it may surprise you what you make on an hourly basis.

PaycheckCity Payroll Self-service payroll for your small business. Hourly employees must be paid premium wages for each hour worked on a holiday plus an additional. If you dont want the download the free rate calculator above the math goes like this.

Salary employees divide the annual salary by the number of pay periods each year. Calculate your FICA. Hourly pay at HEB.

So lets say you need to make 5000month to live expect your business expenses to be about. For those on a bi-weekly schedule you would multiply the number by 26. For instance for Hourly Rate 2600 the Premium Rate at Double Time 2600 X 2 5200.

Calculate the 20-year net ROI for US-based colleges. To calculate your take-home pay follow these steps. 15 600 40.

You may also want to convert an hourly wage to a salary. Hourly employees multiply the total hours worked by the hourly rate plus overtime and premiums dispersed. Janes time and a half pay rate is 2250 per overtime hour.

Calculate your yearly income. Salaried employees comes in the form of adding onto an employees regular pay. An hourly rate as the name suggests is a set amount of money that the employer will pay for each hour that is worked.

Fill out a Form W4 federal withholding form with a step-by-step wizard. Guidelines in Paying Overtime. For example if you have one month to lay the foundation of a new home and you know the foundation requires 1000 hours of labor divide 1000 by the number of eight-hour workdays in the month to calculate the number of laborers.

Visit PayScale to research electrician hourly pay by city experience skill employer and more. Calculate Holiday pay for Hourly vs. This federal hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Hourly To Annual Salary Calculator How Much Do I Make A Year

4 Ways To Calculate Annual Salary Wikihow

Hourly To Salary What Is My Annual Income

Hourly Rate Calculator

Labor Rate Calculator Servicetitan

Hourly To Salary Calculator Convert Your Wages Indeed Com

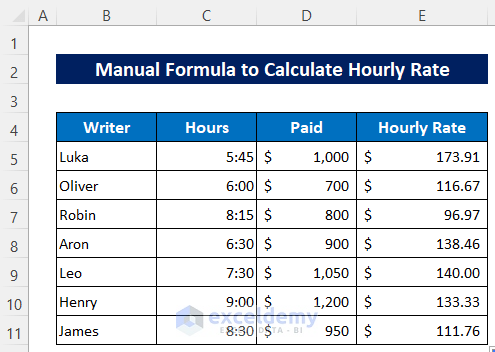

3 Ways To Calculate Your Hourly Rate Wikihow

Annual Income Calculator Online 56 Off Www Ingeniovirtual Com

Hourly Rate Calculator Plan Projections Rate Calculator Saving Money

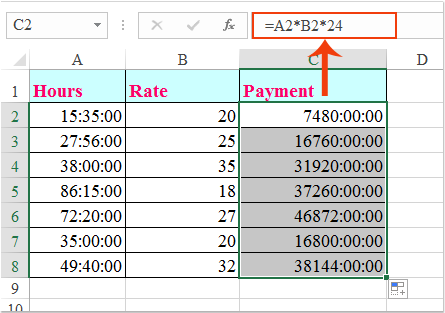

How To Multiply Hours And Minutes By An Hourly Rate In Excel

Wages And Salary Calculator

How To Calculate Hourly Rate In Excel 2 Quick Methods Exceldemy

Hourly Rate Calculator The Filmmaker S Production Bible

How To Calculate Wages 14 Steps With Pictures Wikihow

3 Ways To Calculate Your Hourly Rate Wikihow

Salary To Hourly Calculator

Pay Raise Calculator